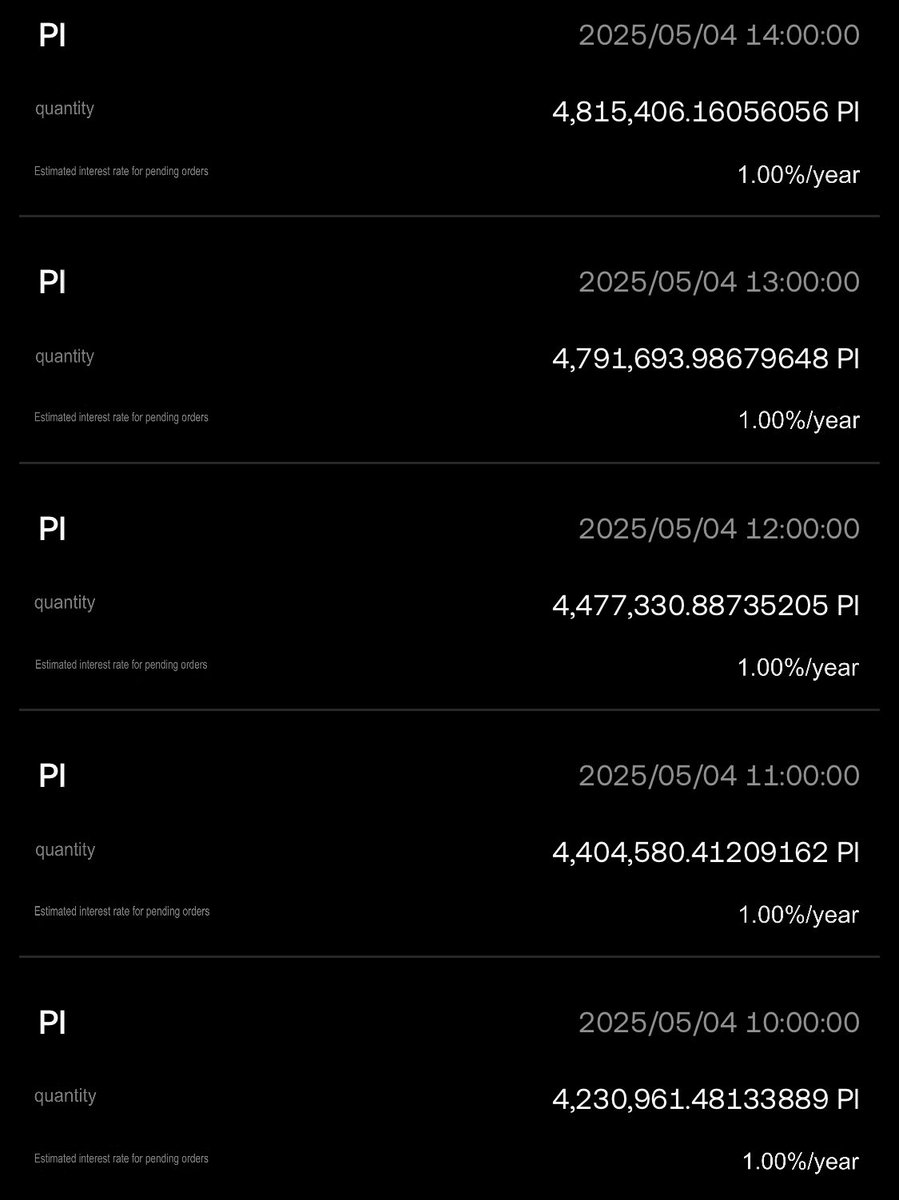

Whales borrowing Pi are taking millions of Pi from lending pools to sell on your behalf.

Thank you to GCV for taking this issue seriously and actively promoting it.

Do not stake Pi on exchanges or use Yu’ebao, as whales are borrowing millions of Pi from lending pools to sell on your behalf.

You invest in Pi hoping for price increases to gain profits. However, the more you stake, the more you enable whales to suppress the price.

Many believe long-term investment means expecting the ecosystem to bear merchants’ costs indefinitely to support the price. Merchants cannot withstand long-term price losses and will eventually exit entirely, causing the ecosystem to collapse.

Like now, if Pi’s price is lower than electricity costs, miners have no reason to pay 1 yuan to the power company for 0.5 yuan worth of Pi.

Smart people know they can buy 1 Pi directly instead of halving their returns. Thus, miners will also collapse, and the ecosystem will die.

Methods to counter whales:

1. Do not stake Pi on exchanges. Do not use Yu’ebao to stake Pi.

2. Drain the exchanges’ lending pools. Convert 1% APY low returns to 34% accelerated mining rewards.

3. Whenever data shows whales borrowing and selling Pi, causing price dips, it’s an opportunity to buy low. Let’s agree to buy at low prices, pull the price up, and make the whales lose money.

Thank you to GCV for also valuing this issue and promoting it vigorously.

Do not stake Pi on exchanges, and do not use Yu’ebao, as whales are borrowing millions of Pi from lending pools to sell on your behalf.

You invest in Pi hoping for price increases to gain profits. However, the more you stake, the more you enable whales to suppress the price.

Many believe long-term investment means expecting the ecosystem to bear merchants’ costs indefinitely to support the price. Merchants cannot withstand long-term price losses and will eventually exit entirely, causing the ecosystem to collapse.

Like now, if Pi’s price is lower than electricity costs, miners have no reason to pay 1 yuan to the power company for 0.5 yuan worth of Pi.

Smart people know they can buy 1 Pi directly instead of halving their returns. Thus, miners will also collapse, and the ecosystem will die.

Methods to counter whales:

1. Do not stake Pi on exchanges. Do not use Yu’ebao to stake Pi.

2. Drain the exchanges’ lending pools. Convert 1% APY low returns to 34% accelerated mining rewards.

3. Whenever data shows whales borrowing and selling Pi, causing price dips, it’s an opportunity to buy low. Let’s agree to buy at low prices, pull the price up, and make the whales lose money.

#pi

Dear Friends,

There is an important thing to pay attention to, everyone redeems the pi in the remaining coin, because this pi will be borrowed by the dealer to short and smash the market, resulting in the price of the currency always falling endlessly, the interest rate of the remaining coins is low, please don't be greedy for small and big, my friend Yu Yuanbao has 20,000 coins, I called him to redeem the coin, and the price of the currency rose immediately after redeeming more than ten seconds, please forward this news in the major factions.

On the homepage of the exchange (Figure 1), you can redeem if you subscribe (Figure 2), and in Assets, you can enter the distribution of coins and turn off the auto-earn function (Figure 3).

At present, if there is no stable trend in the circulation price of the pie on the exchange, the participation of ecological merchants will be affected, and the time point of open source will be postponed, so that the efforts of Dongfang Teacher to lead the pioneer to create a high consensus on the value of the pie for more than 2 years will also be in vain.

From Taiwan China pioneer Webber

149.18K

17

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.