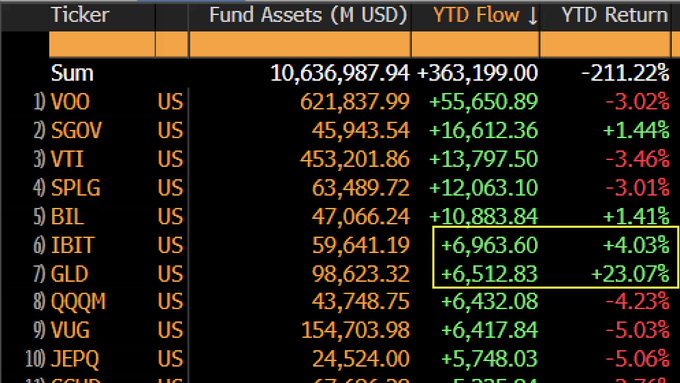

Although only four months of 2025 have passed, based on the total ETF fund inflows in the United States, BlackRock's Bitcoin spot ETF ranks sixth in terms of fund inflows, slightly ahead of gold, which ranks seventh. However, in terms of year-to-date returns, gold leads with a return of over 23%, ranking first, while $IBIT ranks second with a 4% increase.

Among the top five, $VOO, $VTI, and $SPLG all track U.S. stock indices like the S&P, while $SGOV and $BIL are short-term U.S. Treasury ETFs. Therefore, in terms of fund absorption, $BTC has already become one of the most attractive investment targets outside of U.S. stock indices and short-term U.S. Treasuries.

Currently, the large inflow of funds has not caused a significant price surge for Bitcoin, but it does demonstrate traditional capital's interest in bottom-fishing BTC. It's worth noting that, as I monitor Bitcoin spot ETF data daily, I can identify that the main buying times for Bitcoin spot ETFs were in early January, late March, and early April.

These represent traditional capital's FOMO (Fear of Missing Out) at levels above $100,000, bottom-fishing below $80,000, and FOMO above $90,000. These three time points correspond to Trump's inauguration, the significant drop in BTC due to tariffs, and the FOMO sentiment following the suspension of tariffs and stabilization of GDP data.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX.

Show original

29.45K

37

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.