After the news of DeFi starting to loosen up, the attention on DeFi series tokens has significantly increased, with Ethereum series being the most prominent. Other chains' DeFi are also stirring, so I’ve simply listed the lending-related data for ETH, Sol, and Sui chains, starting with TVL / FDV.

The data differences among the three chains are quite large. Solana's Kamino growing to over 2B actually surprised me. I also quite like Fluid in the EVM ecosystem, which is catching up 💥.

As for the Sui ecosystem, it hasn't exceeded 1B TVL yet. On one hand, it faced previous hacking incidents, and the drop in $SUI's price has also had an impact. For me, the maturity of a lending ecosystem can reflect its current growth stage.

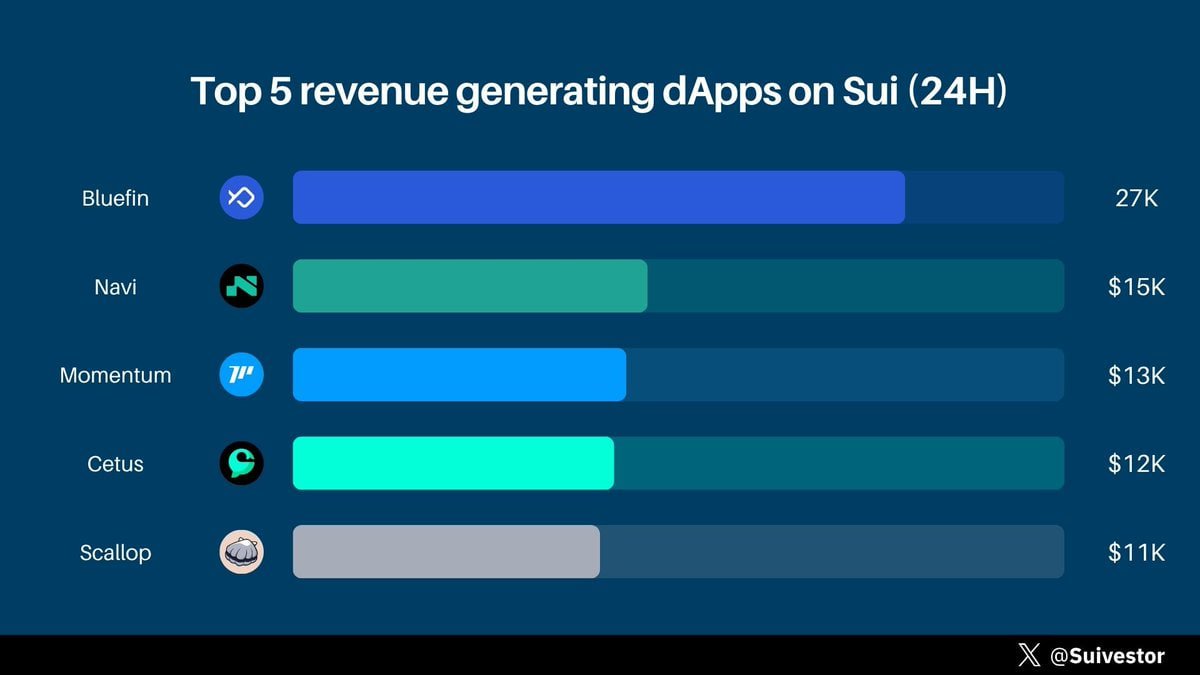

I feel that the Sui ecosystem has also started to roll recently, with Navi evolving from its original lending business to "liquidity staking" (Volo LST), aggregated trading ( @astros_ag aggregator), and other product lines. The lending protocol's revenue has already exceeded 5 million USD.

In simple terms, having better liquidity capture ability naturally boosts business revenue data, leading to greater growth potential. When $SUI warms up later, the growth of these DeFi data will be a very important indicator.

What is $NAVX, which is now live on Binance Alpha? @navi_protocol

$NAVX is the native token of @navi_protocol. Currently, @navi_protocol's TVL has exceeded 500 million USD, with over 900,000 cumulative users, and the lending protocol's revenue has surpassed 5 million USD, making it the second-largest protocol in the @SuiNetwork ecosystem 💥

In the @CetusProtocol incident, @navi_protocol responded quickly by lowering the supply cap and suspending lending to protect liquidity, subsequently recovering over 30% of its TVL, demonstrating a rebound in user trust.

What other updates does the team have recently, and what is @astros_ag? 👀 Let's take a look.

Thanks to @Seasui23 for the addition. When using the Navi aggregation trading feature, be careful about the fees; you need to pay special attention to this before trading.

85

32.33K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.