⚡️ENSO - Community First: Lower FDV and better terms than VCs - Should you participate in the CoinList public fundraising opportunity?

I just saw on Enso's official Twitter @EnsoBuild that they launched a community round financing on CoinList. They are selling 4% of the total supply (4 million tokens) at a fully diluted valuation (FDV) of $125 million. If you're interested, you can participate:

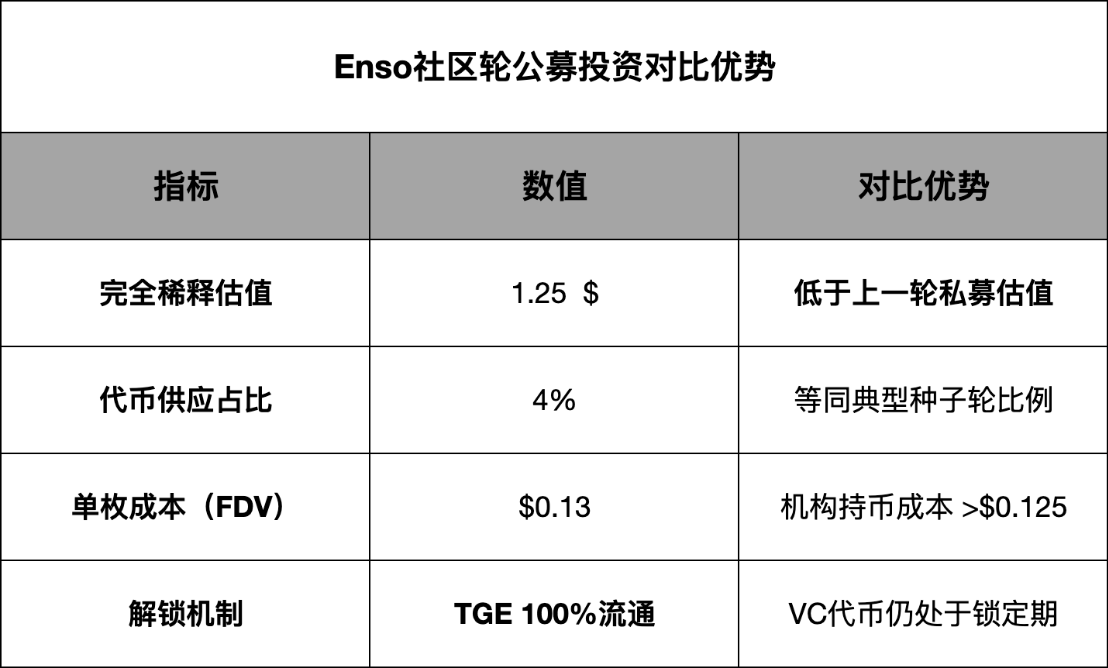

Key highlights of the community public offering:

- Historically low valuation: Community round FDV ($125 million) is lower than the previous private round valuation, with retail investors getting better terms than institutions for the first time.

- 100% TGE unlock: Community tokens have no lock-up, while VC tokens are still in the lock-up period.

- Mature product validation: Supports over $15B in on-chain settlements, serving over 100 production-grade projects.

- Next-gen Web3 infrastructure: The only integrated development tool that provides both on-chain data reading and transaction execution.

1. Comparative valuation opportunity:

The similar infrastructure The Graph ($GRT) has an FDV of $1 billion, only providing data layer services.

Enso's valuation is only 12.5% of $GRT, yet it has a "data + execution" dual engine and is supported by over $15B in real settlement volume. The TGE is scheduled for Q3 this year.

2. Token economic model

Token name: $ENSO

Total supply: 100,000,000 tokens

Current round allocation: 4,000,000 tokens, accounting for 4%

FDV (fully diluted valuation): $125,000,000

Start time: June 12, 2025, 17:00 UTC

End time: June 19, 2025, 17:00 UTC. According to previous practices, private round valuations usually include a lock-up period of 12-24 months, while the community round public offering provides immediate liquidity, further amplifying price advantages.

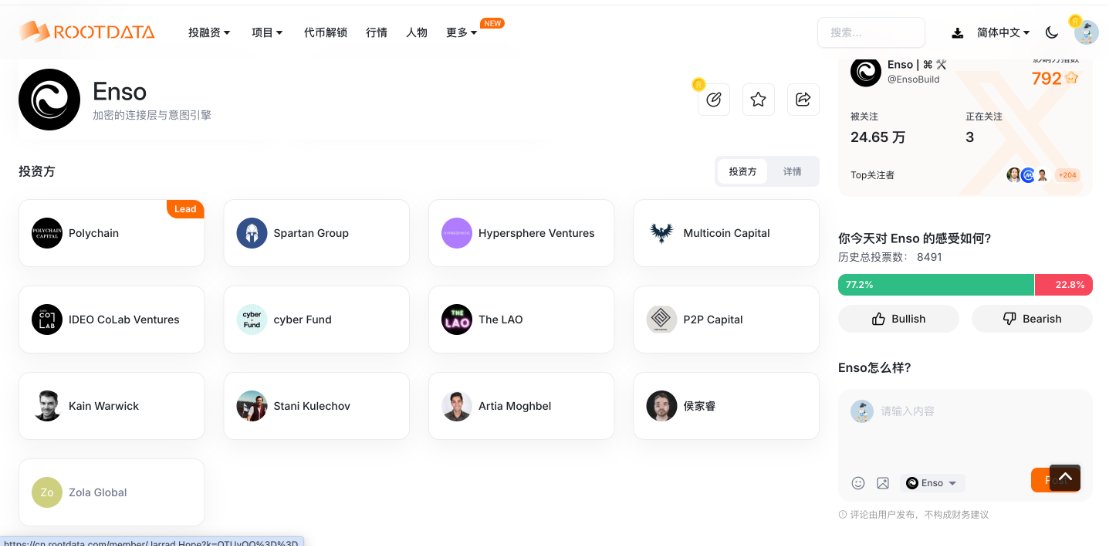

4. Institutional endorsement

Top-tier capital lineup:

- Lead investors: Polychain, Multicoin Capital

- Co-investors: Spartan Group, IDEO CoLab

- Angel investors: Founding teams of over 70 projects including LayerZero, 1inch, Yearn, etc.

Core opportunity for participating in the community round: historically low valuation + immediate liquidity + institutional cost inversion. If you're interested, take a look, and you can also continue to test the testnet for free; the TGE is coming soon!

Show original

24

13.84K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.