⚡️ I just saw @FlareNetworks TVL soaring by 1700% on @DefiLlama, and I was curious to take a look, it was USD₮0 that went online, which detonated the Flare ecosystem - to summarize the logic of flare's TVL and token value rising

USD₮0 is the US dollar stablecoin on the Flare network, FXRP is the encapsulated version of XRP on the Flare chain, through this mechanism to achieve XRP liquidity release and portfolio innovation in the DeFi ecosystem, USDT0 ignites the XRP DeFi engine!

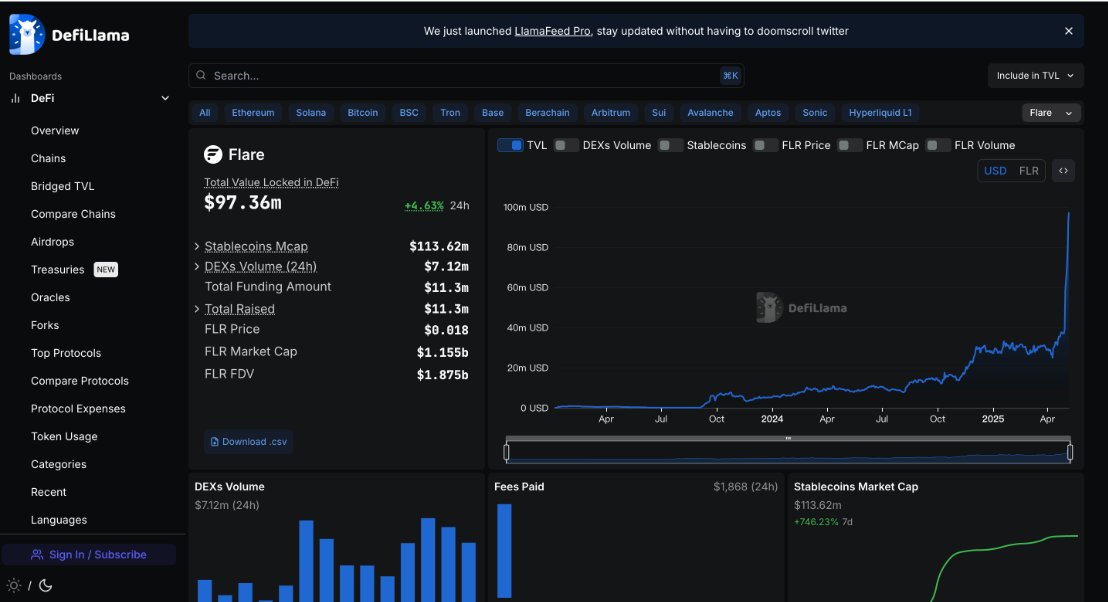

1. The market value of Flare TVL and stablecoins has soared

● TVL exceeded $110 million: After USDT0 was launched, the market value of Flare's on-chain stablecoin soared by 1,700% within a week, and more than $69 million USDT0 was minted, directly pushing TVL to jump to $110 million, becoming the fastest growing chain month-on-month

● Leap in capital efficiency: The native deployment of USDT0 solves the security risks of traditional cross-chain bridges, and at the same time provides a stable liquidity entrance for DApps in the Flare ecosystem, activating the capital utilization rate in scenarios such as lending and trading

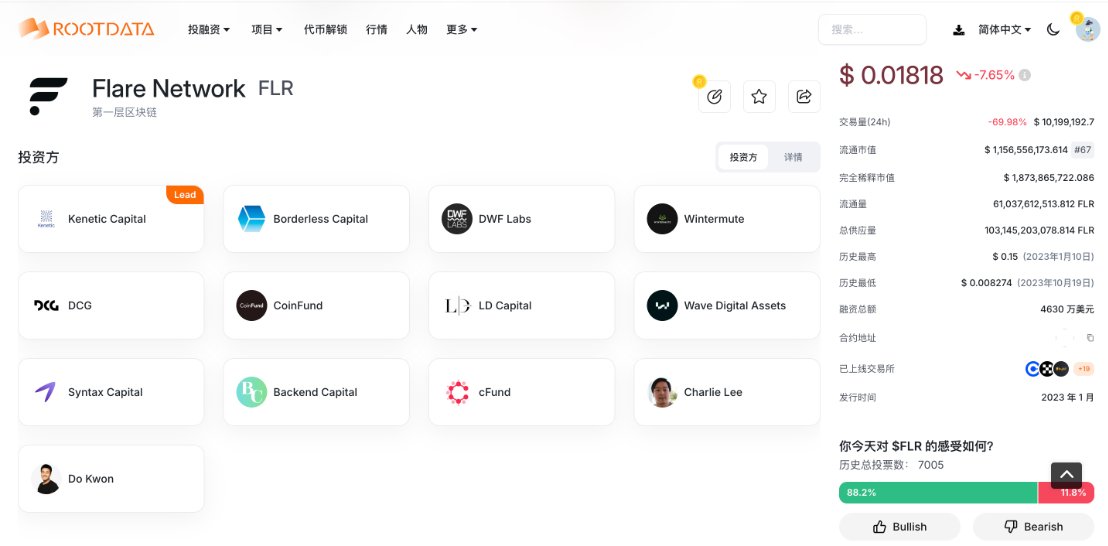

2. Revaluation of FLR token value

● Price performance: FLR tokens rose by 23% on the 7th and 50% on the 30th, and the trading volume of CEX and DEX remained stable at more than $30 million and record highs respectively, reflecting the market's recognition of the ecological potential

● Staking and governance value: 67% of FLR tokens in the Flare network have been staked to ensure the security of oracles (FTSO V2) and further strengthen the utility and scarcity of tokens

Third, the future of the six likely positive

- Follow-up product roadmap

FAssets Launched: FBTC and FXRP will unleash trillion-dollar liquidity in the Bitcoin and XRP ecosystems, becoming the core drivers of Flare TVL's growth

-- Institutional entry and compliance

Kraken integration: USDT0's institutional-grade liquidity channel on the Ink chain has been opened, and more compliant financial products may be introduced in the future

RWA track layout: Flare oracles and data capabilities can support the on-chain listing of real assets such as tokenized treasury bonds and real estate, and form synergies with protocols such as Ondo

-- Market expectations and valuation space

Benchmarking against similar chains: Flare TVL (110 million) is still far lower than Avalanche (2.28 billion) and Chainlink (16 trillion transactions), and the valuation gap is expected to narrow if the ecosystem continues to be enriched

XRP Ecosystem Empowerment: As the first chain to provide smart contracts and DeFi capabilities for XRP, Flare may become the core platform for XRP holders to earn and farm

4. Conclusion: Flare's DeFi curve has just launched

The launch of USDT0 is only the beginning of the outbreak of the Flare ecosystem, and it is expected that with the implementation of tools such as FAssets and TEE, and the release of liquidity from the XRP and BTC ecosystems, Flare is expected to become a "data + asset" hub in the multi-chain era.

@HugoPhilion @NairiUsher

XRP on Flare is different — it has a flywheel.

USD₮0 brings the capital base

FXRP brings composability

Pair FXRP with USD₮0 → deep liquidity

Deep liquidity → efficient markets

Efficient markets → more DeFi activity

More DeFi activity → more yield and real XRP use cases

This is XRP DeFi. Flare is the engine.

30.02K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.