Stablecoins and Tokenized US Stocks will have similar growth pattern.

@0xlaguna from @vaneck_us also said - “While we’ve been skeptical of various forms of tokenized assets, especially equities, it’s hard not to look back at the early days of stablecoins and recognize similar constraints.”

---My Take:

Stablecoin allowed global access to the most attractive currency, US Dollar.

Tokenized US Stocks will allow global access to the most attractive equities, US Stocks.

The growth will be steady, but won't decrease significantly although market is down.

---

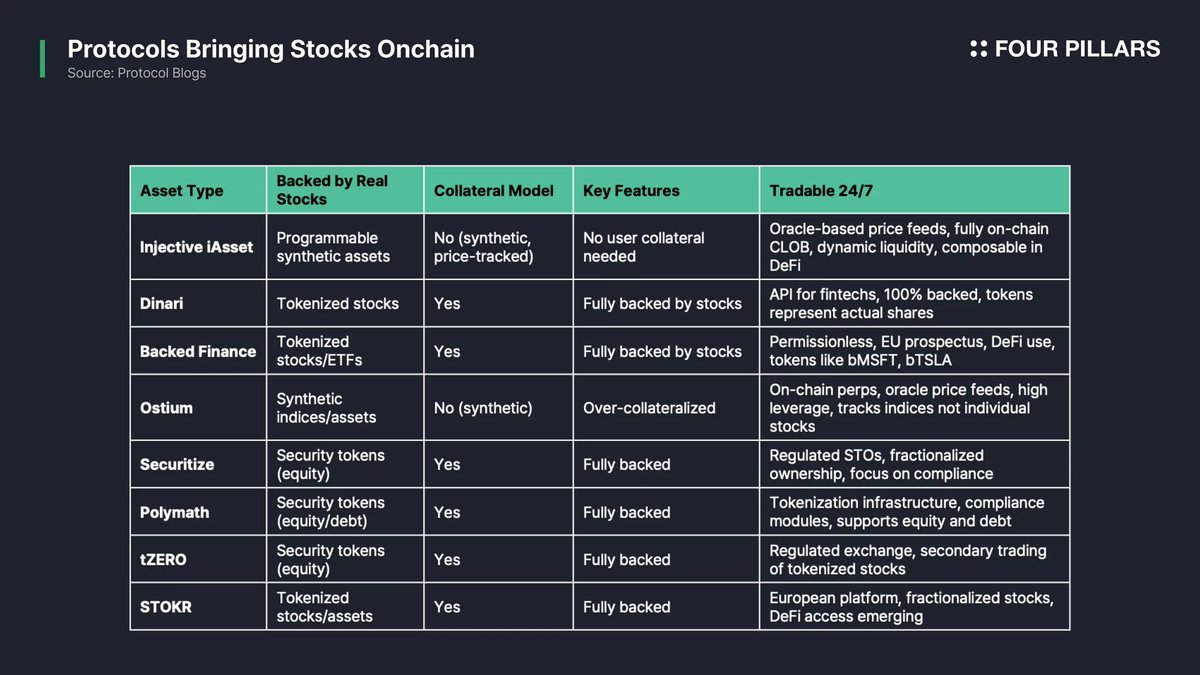

Tokenized US Stock market is difficult to build as it requires regulatory approval. To avoid the regulatory constraints, there have been teams building a synthetic US stocks to bring the assets onchain, for example, Mirror Protocol in Terra, Ostium, Injective iAssets, etc.

However, as the regulation is set to be favorable for crypto protocols in US, there will be protocols trying to have fully backed US stocks onchain.

As stablecoin has gone through the era of unstable algorithmic stablecoin, under-collateralized stablecoins, onchain US stocks would go through similar pattern, from synthetic US stocks to fully backed ones.

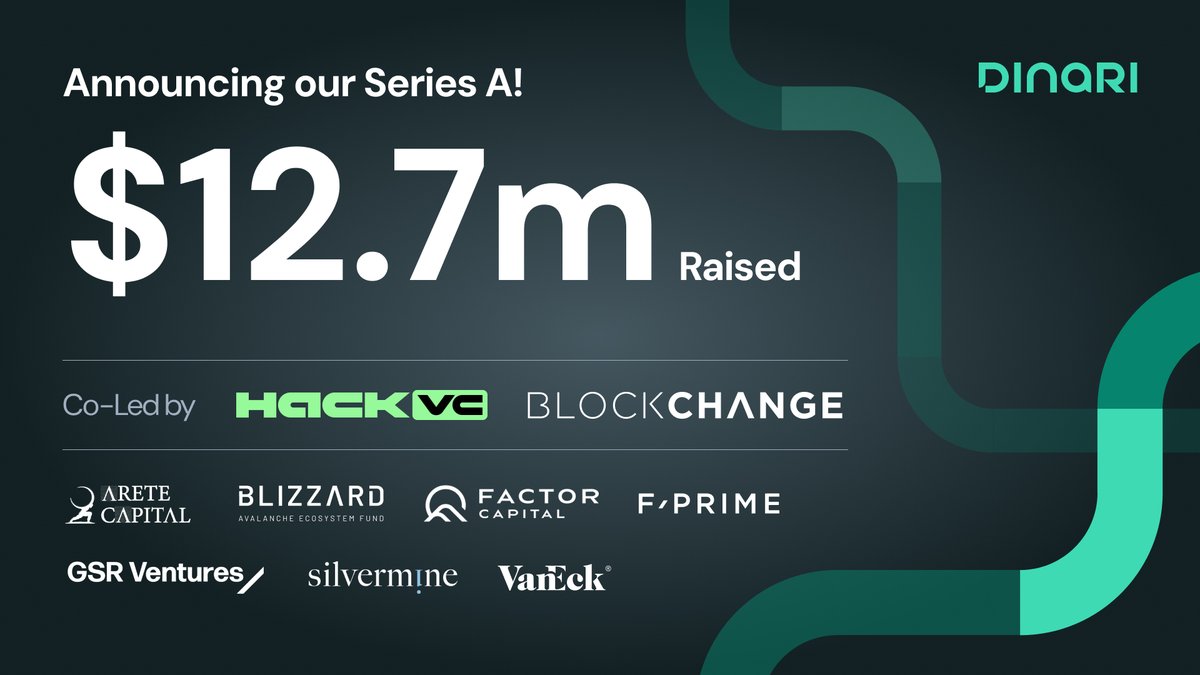

Dinari is and has been building this.

@GabeOtte

@annabelleacta

🚨 Big news from Dinari 🚨

We just raised a $12.7M Series A to bring U.S. equities onchain — and make them accessible to anyone, anywhere 🧵

7.46K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.