DeFi's Regulatory Thaw: A New Era Begins?

Policy Shift: Senior SEC officials express support for DeFi innovation, stating that it aligns with American values of economic freedom and private property rights. Plans are underway to establish an "Innovation Exemption" framework, allowing on-chain products to enter the market more quickly.

Key Positions:

Self-custody and privacy software development should not incur securities law liability simply for publishing code.

PoW/PoS mechanisms do not inherently constitute securities transactions.

Warning against centralized entities misusing the "decentralized" label to evade regulation.

Market Trends:

Regulatory Boost: If the Innovation Exemption is implemented, it could attract traditional capital, accelerating the integration of DeFi with traditional finance.

Intensified Competition: The entry of major players may squeeze the market share of native DeFi projects.

Independent Development: DeFi's reliance on Ethereum is expected to decrease in the future.

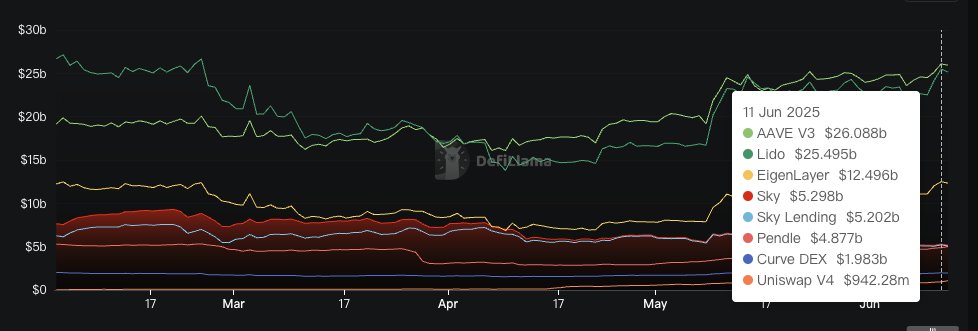

Top DeFi protocol situation and trend

@Aave:

TVL surges to $26 billion (ATH), now expanded across 18 blockchain networks.

"Aavenomics" proposal introduced (token buybacks, revenue redistribution), attracting institutional users (e.g., firms linked to the Trump family).

@Uniswap:

V4 launched, featuring hooks technology to reduce gas fees; Unichain TVL hits $546 million (2nd largest chain after Ethereum).

TVL declined primarily due to ETH price drop, while actual ETH staking volume increased.

@SkyEcosystem (formerly MakerDAO):

TVL dipped after rebranding, but Spark Protocol (RWA-focused) performed strongly, with MKR token price up 170%.

Complex governance reforms may have impacted market perception.

@EigenLayer:

Restaking concept drives TVL to $12.4 billion (ranked 3rd), surging **77% in just 2 months**—prompting a market revaluation of its potential.

9

8.88K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.