Web3 protocols today face a systemic dilemma: High intent, low conversion.

This is a product of the rollup-centric, multi-VM landscape.

Onboarding friction across wallets, chains & complex cross-chain workflows turns many promising users away before they even start.

This is where UX-centric, chain-abstracted services become a GTM unlock.

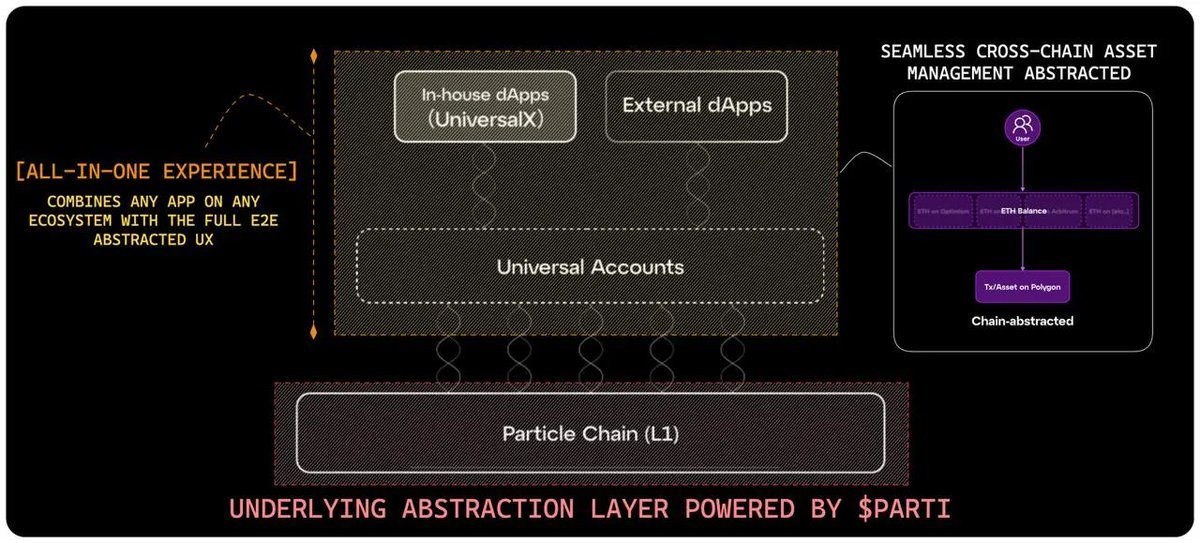

@ParticleNtwrk’s Universal Accounts hits right on the spot:

🔸A single user account that abstracts all the friction.

🔸Deposit on one chain → swap on another → farm on a third

🔸 Unified wallet, identity & dapp experience.

This isn’t just ‘UX enhancement’ imo, its protocol-level infra reshaping how products acquire users, retain liquidity & scale across ecosystems.

------

From Siloed Apps to Networked Protocols:

Chain abstraction enables a paradigm shift: Isolated ecosystem-bound apps → interoperable, network-native protocols.

What was once a thesis is now being proven now.

@ParticleNtwrk’s latest wave of @UseUniversalX integrations signals the first tangible phase of adoption:

🔹@honeypotfinance: Evolved from a @berachain launchpad into a chain-agnostic token launch venue with native reach across chains.

🔹 @zkhelixlabs: Single-chain staking model → omnichain liquidity protocol

🔹 @Overtime_io: Chain-agonistic UX to prediction markets

🔹 @MYX_Finance: Abstracted UX to on-chain perps

🔹 @ClutchMarkets: Borderless experience to prediction markets

🔹 Mantis Network: Simplify cross-chain UX & features

🔹@ChimpxAI : Cross-chain AI intent engine, routing swaps & liquidity in a way that's invisible to the user.

These integrations reflect a growing reality:

Products are beginning to shift their design philosophy & no longer building for individual ecosystems, but for interoperable presence across the broader Web3 landscape.

------

On Network Effects:

As more projects integrate UAs on Particle Network, they tap into a shared distribution layer:

1. Utility scales horizontally as UA users seamlessly interact across protocols.

2. Network effects compound, driving higher retention, composability & shared liquidity.

3. Every integration strengthens the ecosystem for all participants.

The growth effect compounds here much like a ‘super-app’ model in web2 where multi-features are unified mirroring the unification of UA web3 UX.

-----

On Value-Accrual:

Every chain-abstracted action on @ParticleNtwrk is powered by $PARTI, the native asset of its underlying settlement layer (Parti Chain).

More dApp and ecosystem integrations → More user activity → Higher $PARTI demand

This results in direct value accrual tied to network-level growth, positioning $PARTI as the economic fuel powering the abstracted user layer of Web3.

------

TLDR: Chain abstraction isn’t the future. It’s already the new standard.

One account, one balance, any chain also means any dApp.

Today, we're making history by announcing the first Cohort of chain-agnostic dApps in Web3.

Ten initial projects of all kinds, all accessible to users from any chain, with any asset.

They are:

@Overtime_io (Live)

@ClutchMarkets (Live)

@honeypotfinance (Live)

@MYX_Finance (Live)

@mantis_app (Live on Monday)

@BRKTgg (Live soon)

@ivx_fi (Live soon)

@ChimpxAI (Live soon)

@farawaygg (Live soon)

@blumcrypto (Live soon)

... as well as a few more TBA.

Together with @UseUniversalX, they represent the bleeding edge of a unified experience that will soon become the norm across our industry.

If you're a user, try it out. You'll never want to bridge or think about chains again.

If you're a developer, we want you to participate in Cohort Two. Hit us up.

Full announcement and all details at:

3.17K

34

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.