$pendle wen moon

🧐Pendle's Advanced Arbitrage Skills: Double Your Returns with Revolving Loans|Take Ethena PT as an Example——

Recently, I noticed that @ethena_labs's PT assets have been launched on Aave as collateral, and the amount is almost gone. Yes, there should be a mystery that many DeFi players have discovered:

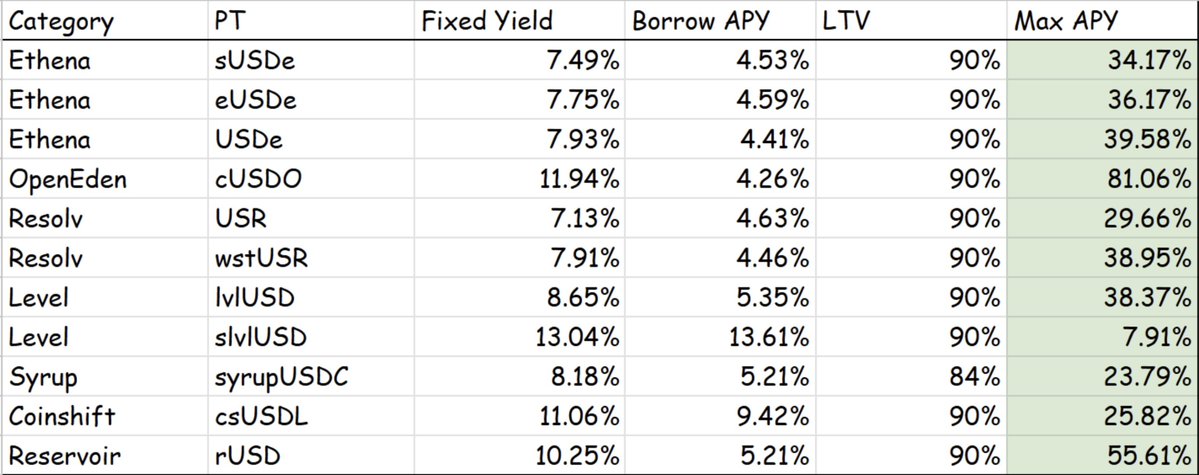

Pendle + Lending Protocol, which can spell out a low-risk leverage structure. If done properly, the annualized rate of return can be 30%.

But this is not a simple leverage, this is a calculated situation, to win fixed income + airdrop points + structural arbitrage, so that Pendle's revolving loan play can become a new round of "smart money game".

Last time, many people asked about this in private messages, and today I will talk about @pendle_fi's revolving loan gameplay——

1⃣ Strategy principle: use PT as collateral and leverage to amplify fixed income

Pendle separates the right to income from the principal, PT = principal certificate, YT = income certificate.

The logic of a revolving loan is simple –

You buy Pendle's stablecoin PT, take Aave collateral, and lend the stablecoin;

Then go to Pendle to buy stablecoin PT - the cycle repeats and magnifies the returns.

This forms a closed loop of "buying PT → collateral → borrowing stablecoins → buying more PT".

So as long as the spread is positive (yield > borrowing cost), you can increase leverage to earn a fixed income.

2⃣ Hands-on process: 5 steps to get started with Pendle PT Revolving Loan

Take PT-sUSDe as an example, you have 1000u initially, assuming an annualized return of 7.5% and an Aave borrowing cost of 5%.

1) Buy PT-sUSDe:

Go to Pendle to buy PT-sUSDe and pay attention to the expiration time

2) Deposit PT into Aave V3 as collateral:

Open Aave V3 and deposit the corresponding PT-assets as collateral

3) Lend stablecoins (e.g. USDC, USDT):

Aave provides a lending function to lend the amount of stablecoins you can afford (e.g. LTV 70%, you can borrow 700u)

4) Continue to buy PT with the loaned stablecoin:

Go back to Pendle and continue to buy PT, remortgage, and re-borrow...... Cycle is formed

5) Set the number of cycles according to personal risk appetite:

It is generally recommended not to have more than 3 layers of circulation (to prevent liquidation risk)

3⃣ Income Model: How Much Can You Earn After Circulating Leverage?

The main sources of income from revolving loans are:

✅ PT Fixed Rate Income

✅ The compounding effect after multiple rounds of leverage

✅ Potential airdrop points (Pendle + Ethena + Aave, if any)

Hypothesis:

PT annualized =7.5%

Aave Borrowing Cost = 5%

Perform two rounds, i.e. leverage = 2.5x

Then net income = (7.5% × 2.5) - (5% × 1.5) ≈11.5% annualized

Even in a low spread environment (7.5% vs 5%), stablecoin yields can still be boosted to 10%+ through leveraged circulation, which is ideal for prudent players to enhance their returns in a structured way.

If you use other assets, the PT interest rate is higher, the borrowing interest rate is lower, and the annualized return can be higher, and some can even reach 70%.

4⃣ Risk warning: Is this risk-free arbitrage?

Any arbitrage is risky, and there is no such thing as risk-free arbitrage. There are several main risks:

❗️ Price Slippage & Liquidity Issues: Multiple rounds of buying by PTs can lead to larger slippage.

❗️ Interest rate changes: Aave borrowing rates are floating and will fluctuate, potentially compressing your spreads.

❗️LTV and liquidation risk: As a non-mainstream collateral, PT has conservative liquidation parameters and may be liquidated once PT fluctuates.

❗️Depeg risk: Although PT buys stablecoins, there is a slight risk of de-pegging of the underlying asset (e.g., sUSDe) itself.

The most notable of these is the liquidation risk of revolving loans.

As the number of cycles increases, both the net return and the APR increase, but so does the liquidation risk factor.

Assuming the current market price of PT-sUSDe is $1.00, there is almost no liquidation risk in the first round of the cycle (the price of PT can fall by more than 12%);

After the 3rd round, as long as the PT price falls by 8.5%, the liquidation will be triggered;

In the 4th round, the liquidation boundary was compressed to only 6%, which is extremely dangerous.

The increase in the number of revolving loans will lead to a narrowing of the risk boundary, especially under high leverage, and each round of increment will compress the fault tolerance space.

Therefore, I recommend a maximum of 1-2 rounds of circulation, and do not be greedy for leverage, which is a safe range that is more cost-effective.

5⃣ Who is a good candidate for the Pendle revolving loan strategy?

Because the revolving loan is a game with several rounds of leverage, there are still certain requirements for the operation threshold. Suitable for the population:

✅ Players who are familiar with DeFi operations and on-chain lending and settlement logic

✅ Steady leveraged party interested in stable income + airdrop incentives

✅ Willing to track the status of the mortgage on a daily or weekly basis, and be able to adjust the leverage at any time

❌ It is not suitable for novice users who do not understand the liquidation mechanism at all

❌ Not suitable for people who are unable to watch positions and manage leverage at all times

6⃣ Conclusion –

Pendle's stablecoin PT + lending = "treasury bonds + leverage" in DeFi, the revolving loan strategy is very similar to the "bond plus leverage to earn interest rate spread" in the TradFi world, the most attractive thing is that the interest rate spread is stable, and the logic is the same.

It's a good window to make, but it's also important to remember:

1) Any arbitrage is to exchange risk for return.

2) Although PT-sUSDe is anchored to a stablecoin, there are still discounts, liquidity, interest rate fluctuations and liquidation risks.

3) When the market is greedy, leverage is often the straw that crushes the position in the end.

Recognizing the structure, mastering the rhythm, and fearing the risk are the three compulsory lessons for Pendle players, and controlling the risk and maximizing the return are the core of survival in the end!

You can enter Pendle's Chinese community, which has many current financial management strategies to learn and reference:

Pendle also has a detailed guide to teaching Chinese:

10.68K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.