⚡️Just saw on @DefiLlama that @FlareNetworks' TVL surged by 1700%. Curious to check it out, it turns out USD₮0 was launched, igniting the Flare ecosystem—summarizing the logic behind the dual rise of Flare's TVL and token value.

USD₮0 is a USD stablecoin on the Flare network, and FXRP is the wrapped version of XRP on the Flare chain. This mechanism enables the release of XRP liquidity and compositional innovation in the DeFi ecosystem. USDT0 ignites the XRP DeFi engine!

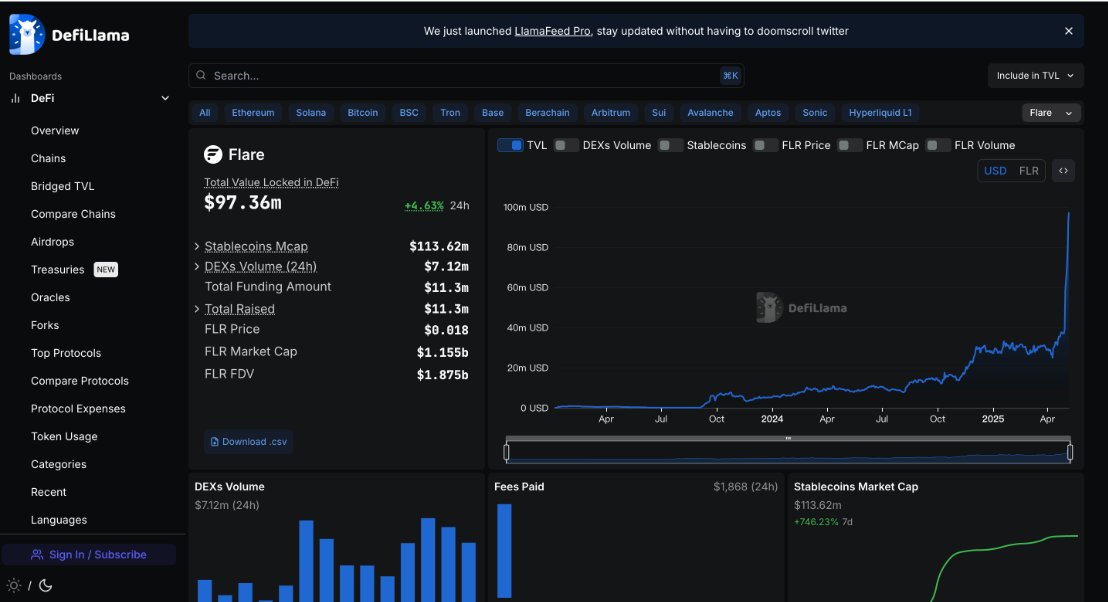

1. Flare TVL and Stablecoin Market Cap Surge

● TVL surpasses $110 million: After the launch of USDT0, the stablecoin market cap on the Flare chain skyrocketed by 1700% within a week, with over $69 million USDT0 minted, directly pushing TVL to $110 million, making it the fastest-growing chain month-over-month.

● Capital Efficiency Leap: The native deployment of USDT0 addresses the security risks of traditional cross-chain bridges while providing a stable liquidity entry for DApps in the Flare ecosystem, activating capital utilization in lending, trading, and other scenarios.

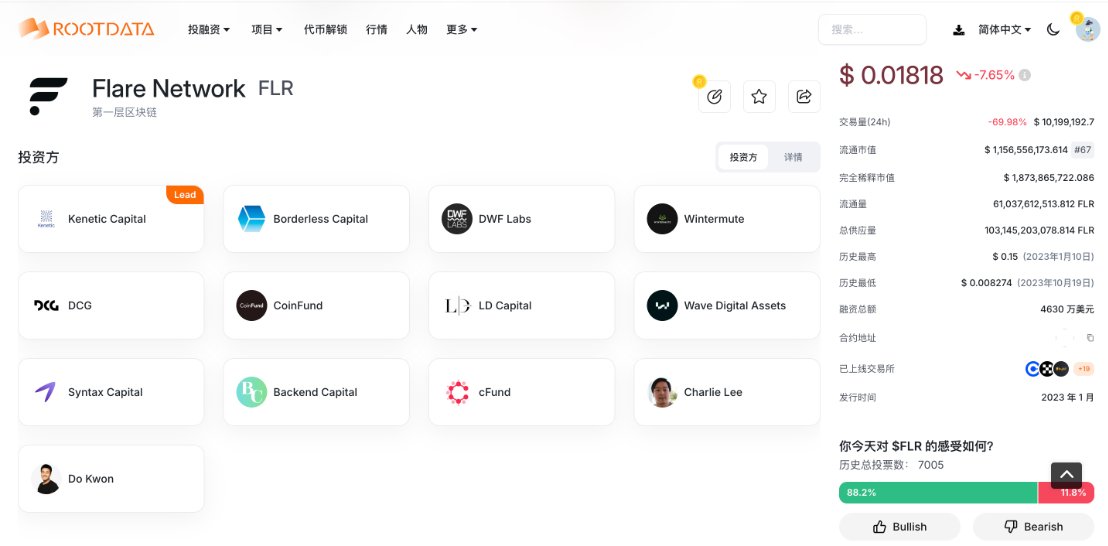

2. Revaluation of FLR Token Value

● Price Performance: FLR token saw a 23% increase over 7 days and a 50% increase over 30 days, with CEX and DEX trading volumes consistently above $30 million and reaching historical highs, reflecting market recognition of the ecosystem's potential.

● Staking and Governance Value: 67% of FLR tokens in the Flare network have been staked, ensuring the security of the oracle (FTSO V2), further enhancing the token's utility and scarcity.

3. Six Potential Future Benefits

——Upcoming Product Roadmap

FAssets Launch: FBTC and FXRP will release trillion-dollar liquidity in the Bitcoin and XRP ecosystems, becoming the core driving force for Flare TVL growth.

——Institutional Entry and Compliance

Kraken Integration: The institutional-grade liquidity channel for USDT0 on the Ink chain has been opened, potentially introducing more compliant financial products.

RWA Track Layout: Flare's oracle and data capabilities can support the tokenization of real assets like government bonds and real estate, forming synergy with protocols like Ondo.

——Market Expectations and Valuation Space

Benchmarking Similar Chains: Currently, Flare's TVL ($110 million) is still far below Avalanche ($2.28 billion) and Chainlink (supported by $16 trillion in transaction volume). If ecosystem applications continue to enrich, the valuation gap is expected to narrow.

XRP Ecosystem Empowerment: As the first chain to provide smart contract and DeFi capabilities for XRP, Flare may become the core platform for XRP holders' yield farming.

4. Conclusion: Flare's DeFi Curve is Just Starting

The launch of USDT0 is just the beginning of the Flare ecosystem's explosion. It is expected that with the implementation of tools like FAssets and TEE, combined with the liquidity release of the XRP and BTC ecosystems, Flare is likely to become the "data + asset" hub in the multi-chain era.

@HugoPhilion @NairiUsher

XRP on Flare is different — it has a flywheel.

USD₮0 brings the capital base

FXRP brings composability

Pair FXRP with USD₮0 → deep liquidity

Deep liquidity → efficient markets

Efficient markets → more DeFi activity

More DeFi activity → more yield and real XRP use cases

This is XRP DeFi. Flare is the engine.

30.01K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.